Amazon and DoorDash Are On a Collision Course

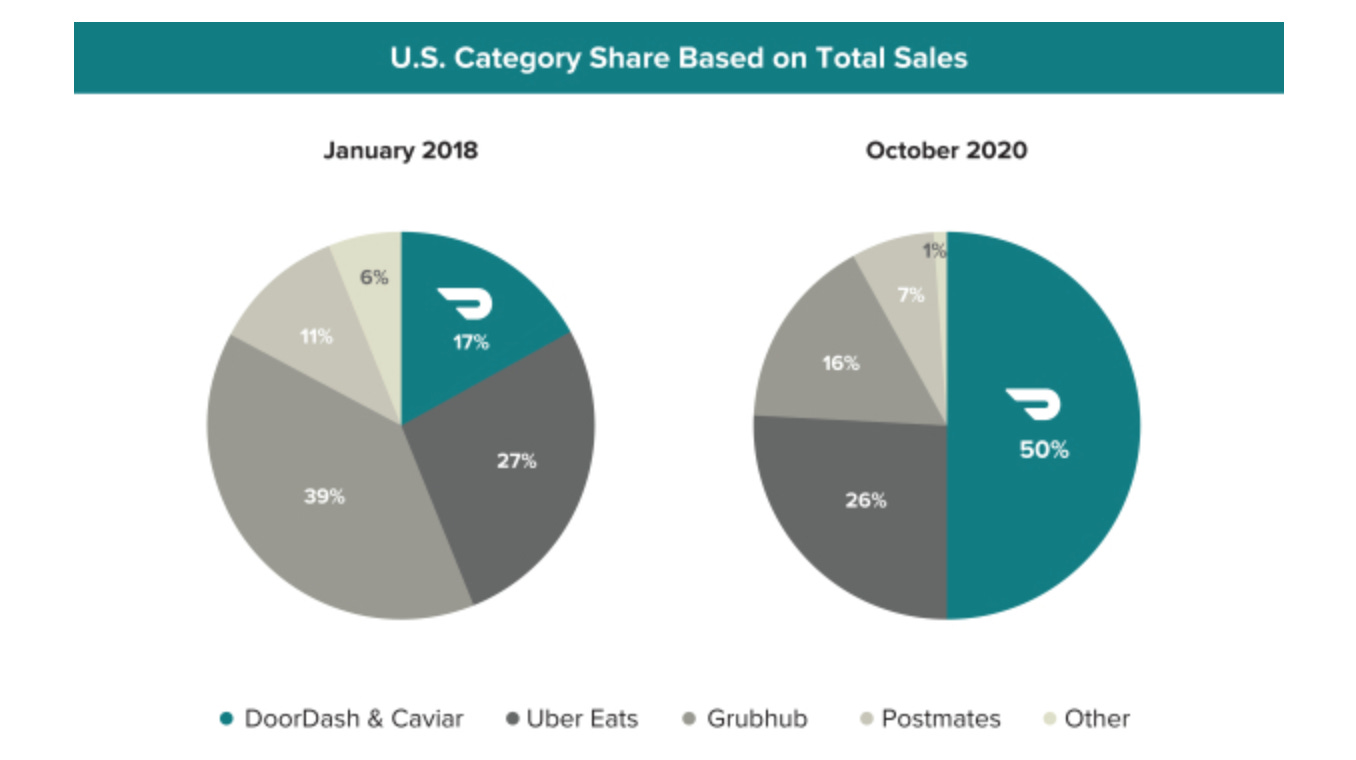

DoorDash filed to go public this week, giving us our first inside look at the company. The consensus response seems to be along the lines of hey, this business isn’t actually that terrible. Of course, not terrible and profitable are two separate things. By far the most striking part of the filing is the chart below. DoorDash is decidedly winning the food delivery wars. Now the company is looking to groceries, medication delivery, and beyond as it seeks to become the last-mile logistics platform of choice. The question is, will Amazon let them?

DoorDash and DashPass

DoorDash launched DashPass, its membership program, in August of 2018. For $9.99 a month, subscribers can order meals from select restaurants with no delivery fees and lower service fees as long as the meal meets a $12 minimum. In a post announcing the new service, DoorDash wrote that DashPass pays for itself if you order three meals a month and, in the company’s pilot, the average subscriber saved over $20 a month and increased their order frequency by 50%.

For power users, DashPass undoubtedly saves them money. By decreasing the fees per order, DoorDash also increases the number of orders and average order value for subscribers. Even better, in the cut-throat world of meal delivery, subscribers to DashPass are more likely to choose DoorDash over competitors.

In a January press release, DoorDash touted DashPass as the largest subscription service in the industry (it had 1.5 million active subscribers at the time). Members saved an average of $4-5 per order with 1 in 3 orders from DashPass members in “top markets.” Now, according to the IPO filing, the service has over 5 million “consumers.” The language change is important as many of these “consumers” likely aren’t paying much or anything at all for the service.

In that same January announcement, DoorDash announced a partnership with Chase that offered free or deeply discounted DashPass memberships for millions of Chase credit cardholders. DoorDash also created a hospital partnerships program that offers free DashPass to over 700,000 healthcare workers. Both of these groups are probably included in that 5 million number.

So then, how has DashPass fared? Without the number of users paying full price or even paying at all, it’s difficult to say. The company reported 18 million monthly active users as of the end of September. If every DashPass user was paying, that’s ~28% penetration. Likely it’s closer to 20%. It’s not terrible but also not great, especially in light of the explosion in food delivery. The growth of DashPass has trailed DoorDash’s revenue growth this year.

So, given the benefits to users of subscribing, why hasn’t DashPass been more successful? For one, it’s pretty pricey for what you get, especially relative to other popular subscriptions like Netflix or Amazon Prime. If you’re not ordering food through DashPass at least three to four times a month, it doesn’t make economic sense.

Consumers will generally act in their best interest. If they’re ordering food more than a couple of times a month, they’ll subscribe to DashPass. If only 20-30% of users are DashPass subscribers, that implies 70-80% of active users only order from DoorDash one to two times a month. Given how much DoorDash spends on marketing and promotions, many of these users’ lifetime value is bound to be negative. Of course, there are exceptions and some users may just be anti-subscription. It’s also worth noting that many users probably order food delivery more frequently but spread it out across multiple apps like Grubhub and UberEats.

If the vast majority of users are only ordering a couple of times a month during COVID (when options outside of food delivery are the most limited they’ll ever be), it doesn’t bode well for DoorDash in a post-pandemic world. To become profitable and own this market, DoorDash needs serious scale. They definitely can’t get there off just 3-5 million users. Or at least, those users would need to be ordering A LOT of stuff.

The Future of DashPass

DoorDash has big ambitions for DashPass. From the IPO filing:

In the future, we envision this membership program becoming a wallet for the physical world, where a consumer can access not only restaurants, but all the local businesses in their community, and receive benefits while shopping in-store, at home, or anywhere in between.

The company also sees a future way more extensive than just meal delivery:

We have already started to serve merchants in other verticals, such as grocery and flowers, but we are still in the very early stages of expanding beyond food. We have just begun our journey and have ample opportunity for continued success in local logistics across verticals and geographies. Our ambition is to empower all types of local businesses, from single proprietors to franchisees, convenience stores to grocers, and florists to pharmacies.

DoorDash wants to become the last-mile delivery service of choice, connecting consumers with their local businesses while taking a cut of the transaction. This all sounds great, except...

Amazon

What other company employs a model that offers cheaper and faster delivery for a subscription fee? Amazon. For $12.99 a month or $119 a year, a Prime membership gets users free two-day shipping, Prime Video, Prime Music, Fresh grocery delivery, unlimited photo storage, and now Amazon Pharmacy.

Amazon is notoriously tight-lipped about Prime subscriber details. The company last reported over 150 million Prime subscribers as of the end of 2019. Amazon has never said how many of its users are Prime members, but research estimates tend to be in the mid-60 percent range. COVID likely caused an increase in both Prime subscribers and new, non-Prime users, so it’s difficult to guess where that number is now.

So, why isn’t the company that wants to deliver seemingly everything not delivering food from restaurants? Well, they tried. Amazon Restaurants was a little known service that the company shut down last year. They didn’t invest much in it, and as a result, it was a poor experience that weighed on the brand. But the company doesn’t appear to have given up its ambitions in the space.

Shortly before they closed Amazon Restaurants, Amazon acquired a 16% stake in Deliveroo, a London-based meal delivery company that operates in Europe and Australia. Amazon still has its sights set on meal delivery. They may just be waiting for the dust to settle in the US meal delivery wars before making a move.

DoorDash vs. Amazon

Between the two companies, you can get virtually anything delivered. While DoorDash has until recently entirely focused on meal delivery, Amazon has been trying for just about everything else. Historically these were very different verticals. Now that’s all changing.

Amazon has been making a significant push into grocery delivery, leveraging its acquisition of Whole Foods. Despite substantial investment, Amazon has failed thus far to make a dent in a market that’s been dominated by Instacart and Walmart Grocery. DoorDash also entered the market in August when it added grocery partners like Smart & Final. They’ll both be battling it out as underdogs to see if they can take share.

Now, both Amazon and DoorDash want to be the one to deliver your medications. DoorDash announced in October that it was teaming up with Sam’s Club to offer same-day delivery for prescriptions for $7.99. Never one to be outdone, Amazon announced Amazon Pharmacy a couple of weeks later. Users can now get their medications from Amazon and Prime members get free two-day shipping. Unlike grocery, prescription delivery is still a fragmented market up for grabs.

DoorDash and Amazon will now be going head to head in two markets, and it seems like only a matter of time before Amazon tries to re-enter restaurant delivery. That doesn’t necessarily spell the end for DoorDash. Despite its boogeyman status, Amazon’s history of launching new businesses is mixed at best. Restaurant delivery is an incredibly challenging market (as Amazon discovered previously). If DoorDash can continue to edge out the current players in the space and create a more compelling membership to engender customer loyalty, they’ll be well-positioned to fend off Amazon.